Grants for energy-efficient building upgrades

Nonprofits are now eligible to apply for up to $100,000 in federal funding for energy-efficient building upgrades through the Building Upgrades Inspiring Local Transformation (BUILT Nonprofits) program. This is the best grant opportunity we’ve seen so far for churches who need to upgrade their HVAC systems!

Mini Grants for Mission

Faith Foundation Northwest is thrilled to announce a new mini-grant program, through which faith communities in Alaska, Idaho, Oregon, and Washington are eligible to apply for $1,000-$3,000 of unrestricted funding to help them carry out their missions. Applications are due September 30, 2024.

Pledge Campaign: should you D-I-Y, buy the book, or hire a pro?

We often get asked which type of pledge campaign we recommend. There are a lot of options, and one size doesn’t fit all. The D-I-Y approach costs the least money but requires a huge investment of time and energy to be successful. Buying a book and following the program requires the least time and energy. Hiring an outside consultant comes with the highest price tag, but can produce excellent results if leadership devotes significant time and energy to following the recommendations. Read on our top resource picks for each of these three types of pledge campaigns.

Faith Foundation NW Prepares for Summer 2024 Board Retreat

Faith Foundation Northwest is excited to announce its upcoming 2024 Summer Board Retreat, set to take place at Lazy F, a UMC Camp in Ellensburg, WA, from August 7-9. The retreat promises a blend of productive meetings, enriching sessions, and engaging activities, in the theme of the Summer Olympics for board members, staff, families, and friends.

Grants for Heat Pumps in Washington Parsonages

Faith Foundation Northwest has been selected by the Washington State Department of Commerce to receive a $519,300 grant through the Home Electrification and Appliance Rebates Program. This funding will allow several dozen Washington churches to install heat pumps in their parsonages at no cost.

To qualify, the gross family income of parsonage occupants must be at or below the 2024 Area Median Income as defined by the Department of Housing and Urban development. Funding will be prioritized to benefit households with the lowest income and/or most vulnerable populations, along with those located in communities that are disproportionately impacted by climate change.

GREEN ENERGY GRANTS FOR CHURCHES IN OREGON

Church trustees: take note as funding from the Inflation Reduction Act trickles down through state and local governments. Here at the Foundation, we’ve sorted through dozens of Oregon grant programs, and identified four that we think churches will be eligible for. If any of the following projects are on your wishlist, keep the associated grant on your meeting agendas in the coming months. First up: EV charging stations for church parking lots— apply ASAP before funding runs out!

OUR FOUNDATION CARES FOR CREATION

Most of the money that Faith Foundation Northwest manages is owned not by the Foundation itself, but by conferences, agencies, camps, and congregations who choose to invest with the Foundation. Each of these bodies has the authority to set its own asset allocations within the Foundation’s family of portfolios. But a small portion of the Foundation’s 90M in assets under management belongs to the Foundation itself, and these monies are being moved into Fossil Free Portfolios this month.

Joy-filled Life and a Joyful Gift

For Marvin and Sandy Thompson, Camp Magruder held a special place in their hearts. It was the place where they experienced faith in Christ, new friendships, and leadership development.

Year-End Giving Resource

December is one of the busiest seasons for church leaders, so it’s easy to put fundraising on the back burner. But the truth is, if you’re not making a year-end-appeal, you’re leaving money on the table.

q3 Market Takeaways

The U.S. economy remains resilient; recession worries pushed to 2024; growth and employment beating expectations

Inflation hits 3.7% year over year in August, up from 3.0% in June

U.S. equities down 3.3% for the quarter, up 13% year to date

Global equities down 4.1% on the quarter, up 7% year to date

U.S. yields higher in Q3; bonds down 3.2% on the quarter and -1.2% year to date

What John Wesley's "3 Simple Rules" Teach Us About Values Aligned Investing

John Wesley's legacy is marked by his teachings on social justice, compassion, and the vital role of actively expressing one's faith through acts of kindness, charity, and service to others. This philosophy urges individuals to consistently seek opportunities to create a positive impact in the world. The instructions to ‘Do no harm, do good and stay in love with God’ provide a simple-but-helpful perspective to guide that action!

Here at Wespath, I see clear connections between these rules and the work we do on behalf of our participants and institutional investors. For example, we are always called to empower our mission of ‘caring for those who serve’ and upholding our core values of Mutual Respect, Teamwork, Integrity, Stewardship, Customer Satisfaction and Spirituality. We also strive to live into our Wesleyan values more specifically through our investment work, including through the actions that guide our Sustainable Economy Framework and our ‘Invest-Engage-Avoid’ approach.

New Tool Helps Us Measure the Impact of Our Investments in Public Markets

While we have always been able to highlight investment strategies and specific investments that help us achieve our aspirational vision for the economy, until recently we were not able to assess if our equity funds in totality are helping to move the world toward a more sustainable future.

To help address this challenge, we recently created an impact measurement and management (IMM) tool to help us understand how aligned—or not aligned—our investment portfolios are with the Framework.

In the simplest terms, the IMM tool is a resource that helps us understand how our investments align with our Framework by highlighting the positive and negative impacts of our portfolios

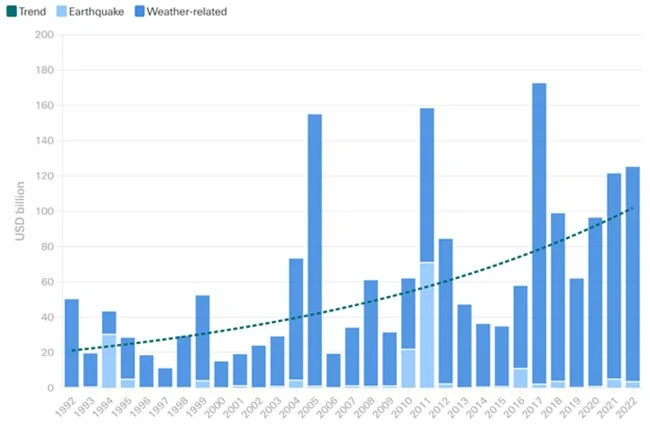

Why Climate Change Is Causing Higher Insurance Premiums and Intensifying the Housing Affordability Crisis

If you own a home in the U.S. and have noticed your insurance has increased over the last several years, you are not alone. The national average for homeowners insurance has been rising for the last five years, with a cumulative increase of 19.1% between 2018 and 2023. There are a number of reasons for this spike, including rising construction costs linked to inflation and, interestingly enough, the effects of climate change.

From SASB to ISSB: Why Investors Need Reliable Sustainability Disclosures

Last month, I attended an event in New York that coincided with the release of the first standards set by the International Sustainability Standards Board (ISSB). For me and others who have contributed to the development of standardized sustainability disclosures for years, it was a cause for celebration. I truly believe ISSB will become the leader in sustainability reporting, helping solve one of the biggest challenges facing sustainable investors today.

I also recognize that many readers have not heard of ISSB and do not know what challenge I’m referring to! With this in mind, I wanted to dive further into the topic in this blog.

Q2 2023 Market Takeaways and Mid-Year Recap

In our latest quarterly takeaways blog, Wespath's Joe Halwax and Neil Sobczak break down market performance and news from Q2, highlighting trends like the rise of AI and recapping the latest on inflation and Federal Reserve policy.

Investing in Commodities: Why We Do It, and Why the Market Has Dipped in 2023

While both equity and fixed income securities had significant negative returns in 2022, commodities were a bright spot. However, commodities were the worst performing asset class in the financial markets in 2023 through May. Wespath’s Andrew Steedman explains what has led to the negative performance of commodities in 2023. And he looks at the impact on Wespath.

Should Investors Be Worried About the Debt Ceiling Debate?

May 15 Update: Negotiations to raise the U.S. debt ceiling are continuing ahead of the June 1 “X-date,” which is the day Treasury Secretary Janet Yellen has warned that the government’s borrowing limits could be reached. President Joe Biden and House Speaker Kevin McCarthy have scheduled meetings this week to discuss a potential deal. Remember that in 2011 a deal was reached just two days before the “X-date,” so while this can be nerve wracking, we have seen this before. To date, U.S. stocks have not seen much debt ceiling-related pressure.

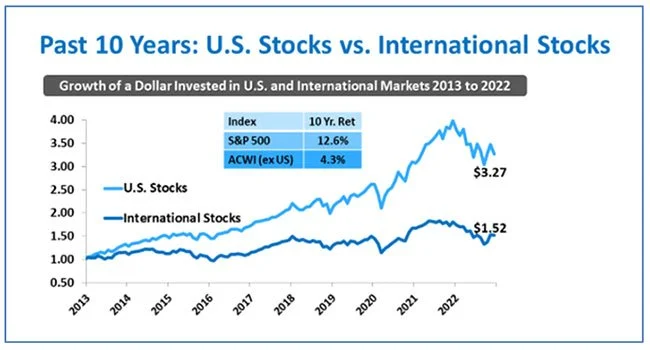

Why does Wespath invest in international companies?

My colleagues Trent Sparrow and Amy Bulger recently penned a blog describing the process for our recent review and refresh of Wespath’s Investment Beliefs. Likening the project to a modern “reboot” of a classic film franchise, Trent and Amy eloquently explained that Wespath’s core convictions haven’t changed. Rather, the subtle updates to our beliefs will help our stakeholders better understand how they influence the way Wespath positions its investments in alignment with our convictions.

I’d like to expound further on one of those beliefs—“Diversified, Long-Term Perspective”—and examine some of the specific investment strategies resulting from it…